I don't think it comes as a surprise to any of us to hear that the cost of living is going through the roof at the moment. Everything that we need to live on, is increasing in price. Fuel, groceries, pet food, essential health products - you name it! As I was compiling last week's Tidbits, I was thinking that it was probably very timely to look at what the Classics can teach us about living well, on a budget. Although many of our favourite classics deal with the wealthy, middle and upper class of British Society (a la Jane Austen), there is still so much to learn and many others from whom we can take our example.

1. Keep a garden

Initially, the set up of keeping a garden can be a bit cost prohibitive but it can be worth it in the long run. The more that we can produce at home, especially essentials like fruit and vegetables, the less we need to pay at out at the shops. There are also the additional benefits that food grown or made at home tastes so much better than store bought food and spending time outside in the garden can be wonderful for our physical and mental health. The classics are peppered with kitchen gardens: Poirot and his marrow garden, the gardens of Little Women, Helen Grahame's kitchen garden in The Tenant of Wildfell Hall, and the Woodhouse's extensive gardens in Emma, to name just a few!

2. Only shop for essentials

There aren't many classics where people will go shopping just for the sake of buying something new. Madame Bovary is guilty of it in Flaubert's classic, and Meg March has a moment or two of weakness in Little Women, but can you think of many others who spend their time at the shops, looking for home decor pieces, new clothes or other non-essentials? Now, I know the time will come when we will need new clothes, underwear, shoes, coats etc and I'm not talking about those times. I'm talking about the extras. The non-essential shopping that our modern society expects us to participate in. So many blogs and Youtubers now work with brands to sell their products and we, as consumers, can be lured into trying this or buying that - even with a discount code! It takes a lot of self-control, but not shopping for things you don't really need will go a long way in helping you live well, within a budget.

3. Mend and Make Do

I have been a long time follower of Jennifer L. Scott at The Daily Connoisseur, and she has espoused this mantra from the beginning. If you buy a few quality pieces, these will be much more beneficial than having many things of poorer quality. Always buying the best quality you can afford will save you money in the long run. In addition to this tip, always buy things that fit you. I always think of Hercule Poirot, a very dapper and well-dressed gentleman who, although his shoes were of the finest quality, they were often too small and pinched his poor feet! There is no point in buying a high-quality piece of clothing, pair of shoes or any other purchase if it won't do the job that you have bought it for. Be discerning with your purchases.

5. Make Hay While the Sun Shines

This certainly isn't a new concept around here! You can read my Bitesize Inspiration on this famous quote by John Heywood, here. Any chance that we can stock up, put something away, pay a little bit extra for higher quality, then we should. When we can afford it, it pays to get ahead. It does not pay to get into debt to get ahead. This is something we want to avoid at all costs. Recognising that getting ahead is a process and takes time, is the first place to begin. Little by little. It is, more than anything, an exercise in 1) patience and 2) planning. Think about what you might need in the coming months. I bought new winter coats for the girls last November in online Black Friday sales. They are in their cupboards now, ready for the coming winter, and at a fraction of the cost than what they are now that we are actually approaching winter, I am glad that I planned ahead. Children grow. They will need new clothes every year (and that includes good quality second hand clothing too). Think about what they might need off season and plan ahead.

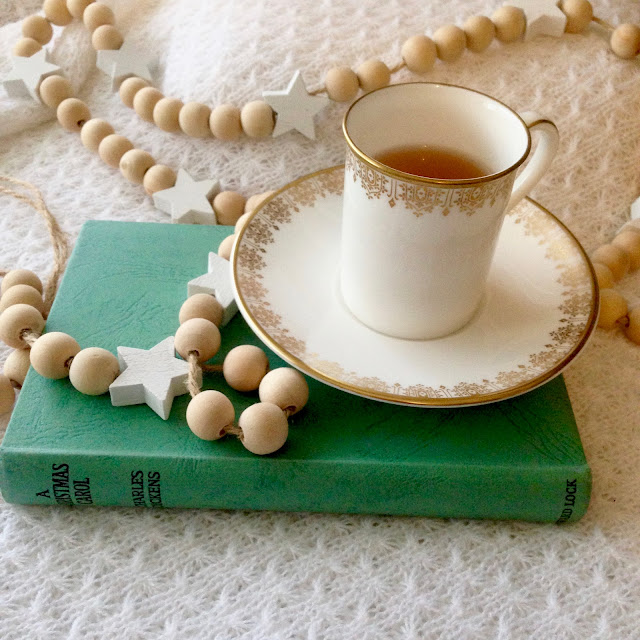

6. Recognise the Happiness of Those Who Have Less

I heard this one from Joshua Becker on Youtube and I absolutely love it! Becker is the author and creator of Becoming Minimalist and offers lots of great advice on how to avoid over-spending and over-consumption. Of course, the March sisters come to mind when I think of this tip. They are considered poor, yet most of the novel they feel themselves rich and happy. Yes, there is some grumbling discontent (they are young girls after all), but deep down, they are content and jolly. Another example that comes to mind is Scrooge's nephew Fred in Dickens' A Christmas Carol. How happy are Fred and his family, compared to the lonely old miser Scrooge, even though they have far less. It's so important to look at people (or characters) who have less, or are considered "poor" and see how much happier they really are. It helps remind us that we actually need very little to be happy and that for most of us, there is already a lot to be thankful for in our lives. One of my favourite books of all time, A Harp in the South by Ruth Park, looks at the very poor lives of an Irish immigrant family in Surry Hills, Sydney in the 1940s. I love to read over the little pleasures the children get throughout the week, or when there is enough money to be some fresh vegetables how happy they all are. Their life was extremely tough and it reminds me that Australians were living this way less than a hundred years ago, and indeed, many still are. These sorts of books really help to put things in perspective, and I'm sure we can all find something to be thankful for.

7. Join the Public Library

I can't stress this point enough. It is the best way to gain all the inspiration from the classics - novels, literature, poetry, art books, classic movies and more, for free! It's the easiest way to find free entertainment to enrich your mind and improve your spirits. You won't feel poor when you can read different books to your children, watch new movies, learn a new skill, or read up on your favourite artist, historical period or musician. Your public library can also have many online resources, so you can read online. In a similar vein to this, you can also plan many free outings to museums and galleries. Most cities have a variety of these to visit, and many of them are free for the standard exhibits; you may have to pay for special exhibits but if money is tight, just enjoy the free portions. Many also have free hands-on fun for younger visitors. If you haven't already, why don't you look into it?

8. Cook at Home

Other than some Agatha Christie books, I don't know many classics where people pay money to eat out of home. Most of the time the meals are prepared at home, often using produce from the garden. In The Little House on the Prairie books, we see Laura and Mary taking their lunch to school each day. Meals are always eaten at home and cooked with the best products the family can afford. Sometimes this is beans with a little piece of salted pork added to it for flavour. Eating out, or buying ready made meals is a relatively new practice, and something that we don't need to subscribe to, especially if money is tight. Learning to cook a few family favourites and rotating through these will save you so much money in the long run. In fact, I'm sure many of you are already doing this, but I thought I would pop it in here anyway as a timely reminder (also for myself! 😊) If you don't know how to cook, then use that public library card and borrow some books. Start simple (avoid the gourmet French cookbooks!) with basic, cheap ingredients like pasta, potatoes, beans, tinned tomatoes and cheaper cuts of meat. Find out when your local supermarket's or butchers' sale day is, and shop then. Many supermarkets mark meat prices down at the end of the day for a quick sale, so if possible, shop then.

9. Change your Mindset

When Sara in A Little Princess loses her wealth and prestigious standing in the girls' finishing school she attends, her mindset becomes more determined to look on the bright side of life. Now, don't get me wrong, Sara was naturally a positive, optimistic person so this wasn't as difficult as it might have been for a glass-half-empty type of person. However, she used her determined nature to look for the good things in her new life, and she found them in good friends, imagination and happy memories. Sara's situation wasn't permanent, and oftentimes, neither are ours. By choosing to view this period with an optimistic lens, we can certainly improve our everyday lives. The power of positive thinking in negative circumstances can work wonders. There is a reason that the Monty Python boys were famous for their classic song, Always Look on The Bright Side of Life. Remember, smiling, laughing, whistling, dancing and enjoying life are all free! Change your mindset when things are bad and remember that these periods can be temporary and better days lie ahead.

If you have access to your own classics, perhaps you can share some tips in the comments below about your favourites and how they live well when money is tight. This list is far from exhaustive, so if we can add to it then that would be great. Now is the time to support and encourage each other. We want to be able to share with each other when time's are tough, both in deeds and in our words and advice. I'd love to hear your thoughts! Have a lovely weekend, everyone 😊

Comments

Post a Comment